The Biggest Bank Robbery of All Time by Robbers all with PhDs and MBAs in a nutshell

Photo:eureporter.co

'Explaining the Current Financial Crisis'

by Dr. Kamran Mofid, Economist

‘On 10/6/08 Dr. Mofid, an internationally renowned economist, and founder of the Globalisation for the Common Good, in a letter to his subscribers, wrote the following on the current economic crisis:’

N.B. First, a bit of explanation!

I wanted to write something simple, jargon-free, easy-to-understand on the 10th Anniversary of the Financial Crisis, for all those, lucky enough, not to have a PhD in Economics (The once elegant, beautiful, moral subject, now turned into a dismal science of mumbo-jumbo). More on this later.

I began to search. I began to do the usual thing we all do first these days: The Google search!

After a while, I noticed my own name, explaining the financial crisis! What a discovery that was!

On 6 October 2008, soon after the financial crisis, I had sent an email to the GCGI email list, trying to explain a thing or two about what had happened in the month before, why and how, as well as what lessons can be learnt, etc.

Then, an organisation, ‘The American Muslim (TAM)’, somehow had been forwarded my email and they had decided that they should post my email on their website for a wider readership. I am most grateful to them for their insight.

After reading it again, now, in September 2018, I decided that, I can not better it, I cannot write anything more. And there you have it! True and relevant today as it was when written.

See that original email below. I have copied it, as it was written first, the email to my friends, our GCGI family. (Please note: I have not changed, edited, modified anything. It is, as it was in 2008)

The Biggest Bank Robbery of All Time in a nutshell

$29,000,000,000,000 (This is the cost of bank bailout to the US taxpayers by 2011. A clear sign of Socialism for a few-They get all the benefits and profits- and Capitalism for the many -They get all the losses and costs-).

Global Total Cost? Your guess is as good as mine!

The total cost must surely be incomprehensible.

They robbed the banks and we, the people, got the AUSTERITY!!

What Happened to JUSTICE? You may ask!

Understanding and Responding to the Financial Crisis

‘Explaining the Current Financial Crisis’

( As explained in October 2008, and, as valid and true today)

Photo:i.ytimg.com

‘In the last couple of weeks, 100s of billions of Dollars, Pounds and Euros of taxpayers money have been poured down the drain to bail out a non-functioning, unregulated, unaccountable financial system. The money that we were told was not there to pay for improvements in health, education, housing, transportation, pension, child care,..to name but a few. Moreover, no body has been charged yet: one law for them and another one for the taxpayers! The profits were privatised when the going was good and the costs have been socialised, now that the going got tough, heaven on earth for them and hell for the taxpayers!

Where are the market forces now, you might ask? Where are all those neoliberal economists now, singing the praises of the market, deregulation, liberalisation, privatisation, free trade, share/property-owning democracy,..? Where are they now, telling us how to maximise our profits and income, how to minimise our costs and how to exploit the natural resources, all for the sake of maximum economic growth, and then tell us how to externalise the costs and consequences to the taxpayer or to the people of Bangladesh for example, when they get flooded.

Where have they gone now? Why are they so quiet now, not sharing their wisdom on the wonders of the market and competition and scarcity with us all! I wonder if all these billions that taxpayers have given will work in rescuing the economy where mammon has taken over? My answer is: it will not, as long as the so-called experts/economists do not admit that without humanity, ethics and justice, economics and business are house of cards built on shifting sands.

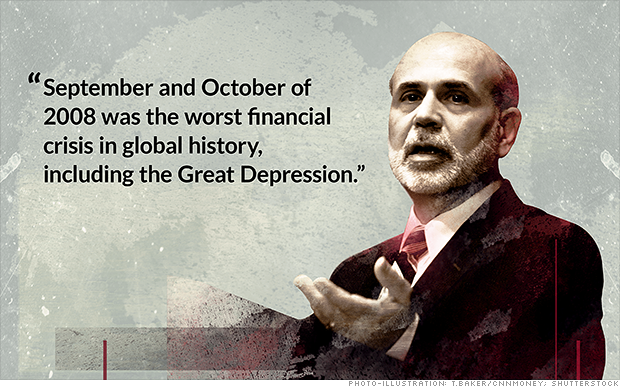

Many millions of words have been written on this meltdown, on what went wrong, but not much on why it went wrong. The overwhelming majority agree on the role of one vital element: dishonesty fuelled by greed. We forget at our own peril that honesty and greed are essentially spiritual and moral issues.In the last few weeks the greed of Wall Street and the City (London financial district) has been under the spotlight. The Archbishop of York recently- and in my view correctly- called some of the traders bank robbers. “We find ourselves in a market system which seems to have taken its rules of trade from Alice in Wonderland”, the Archbishop remarked. The Archbishop of Canterbury has also criticized “trading of the debts of others without accountability” and compared unfettered belief in the market with fundamentalism. This last word “fundamentalism” used by the Archbishop means a lot to me. It is the fundamentalism of economics, its teaching and MBA programmes that is, in my view, the shifting sand upon which we have built this house of cards, called economic globalisation, which has now come home to roost.

The Chicago Boys school of economic thought, has proven to be an emperor with no clothes!

As long as this curse persists, there will be no possibility of reaching the Promised Land: where we can have justice, peace, happiness and contentment.

The Curse of The Chicago Boys

As it has been noted, the so-called “famous school of economics at the University of Chicago led by the late Milton Friedman spread its market fundamentalism worldwide. Greed, selfishness, individualism and short-termism were conflated with freedom and democracy and elevated to the status of moral philosophy. The fatal flaws of this ideology has fueled the reckless risk-taking, greed and arrogance that led to Wall Street’s downfall, and the loss of confidence in financial/banking sectors the world over”.

Let us recall Milton Friedman’s infamous single bottom line: the only purpose of private enterprise and corporations is to make as much money as possible for the shareholders. In the last few decades academics created “free market” curricula, and business schools reaped grants from corporations and from conservative and gullible liberal foundations. Media joined in promoting the “beastly spirit” of individual entrepreneurs, the glorification of business leaders and the “wealth” of Wall Street raiders, hedge fund titans and private equity kings. Money is seen as the only form of wealth”.

I believe this must be highlighted, as without this understanding we cannot provide any solution or an alternative. It is immoral and an affront to humanity to spend the taxpayers money on this bail-out, without admitting what has caused the calamity to begin with. After Enron and WorldCom we were told never again, how wrong they were and how naive we were. For the last few years I have been arguing against economic/money-driven/fundamentalist/neo-liberal globalisation. As Albert Einstein has reminded us,“The world cannot get out of its current state of crisis with the same thinking that got it there in the first place”. Therefore, we must change from the ideas and values of the Chicago Boys, currently the dominant or the only philosophy used in the teaching of economics and MBA programmes the world over, to a sacred and spiritual teaching of economics, rooted in ethics, morality, spirituality and the common good.

The focus of economics should be on the benefit and the bounty that the economy produces, on how to let this bounty increase, and how to share the benefits justly among the people for the common good, removing the evils that hinder this process. Moreover, economic investigation should be accompanied by research into subjects such as anthropology, philosophy, politics and most importantly, theology, to give insight into our own mystery, as no economic theory or no economist can say who we are, where have we come from or where we are going to. Humankind must be respected as the centre of creation and not relegated by more short term economic interests.

‘Economic rationality’ in the shape of neo-liberal globalisation is socially and politically suicidal. Justice and democracy are sacrificed on the altar of a mythical market as forces outside society rather than creations of it. However, free markets do not exist in a vacuum. They require a set of impartiality in government, honesty, justice, and public spiritedness in business. The best safeguard against fraud, theft, and injustice in markets are the cardinal virtues of justice, temperance, fortitude, and prudence, and the theological virtues of faith, hope, and charity.’

See the original source of the excerpts above

MUST READ related articles:

The Destruction of our World and the lies of Milton Friedman

Bastard Economics of Greedy Neoliberalism and the Killings of the Innocents in London Tower

People’s Tragedy: Neoliberal Legacy of Thatcher and Reagan

Neoliberalism and the rise in global loneliness, depression and suicide

Student Suicides at Bristol University: My Open Letter to the Vice-Chancellor, Prof. Hugh Brady

Economics and Economists Engulfed By Crises: What Do We Tell the Students?

The 2008 Financial Crisis Explained: Hyman Minsky Revisited

Open Letter to Mark Carney, Governor of the Bank of England

The Journey to Sophia: Education for Wisdom

What might an Economy for the Common Good look like?

"Why Thieves And Crooks Now Rule The World And How To Take It Back"

The London Banker who Invented the Offshore that has broken the world

Then we might realize that in terms of value creation, it just doesn’t pay to be a banker.

Lest we forget: The bankers danced all the way to the banks, whilst the masses cried all the way to misery, loss and austerity

'We need a fairer form of capitalism: ‘An economy for all’

A radical overhaul of Britain’s economy is needed to address chronic disparities in living standards since the 2008 financial crash, according to the IPPR thinktank. Its commission on economic justice argues in a report published today that the shareholder-driven model of capitalism is outmoded, with the UK held back by a culture dominated by decades of short-term profit taking, weak levels of investment and low wages.